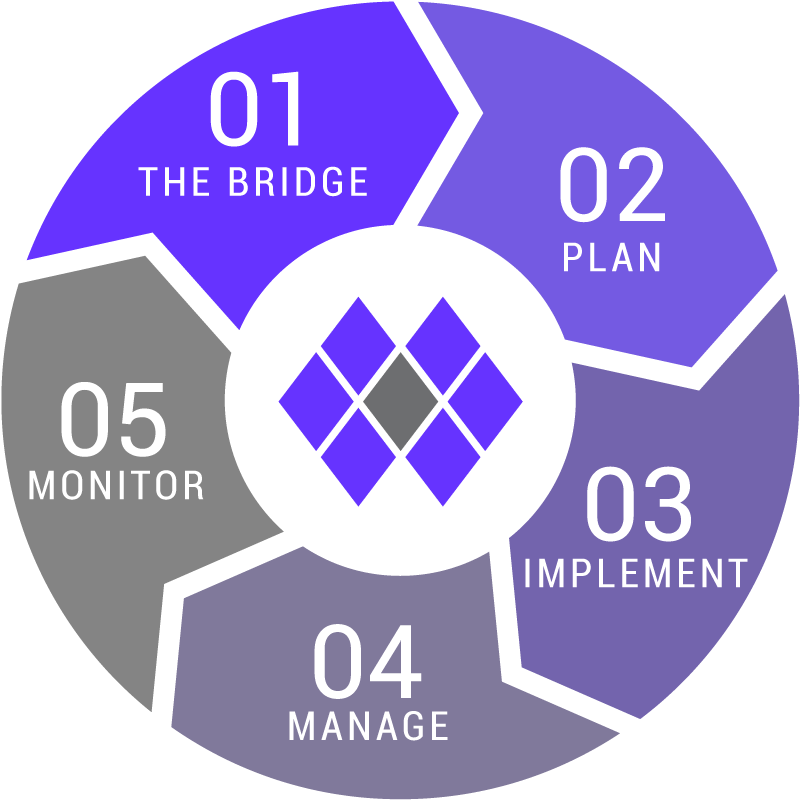

We are a team of problem solvers. We work with families & business owners to provide solutions for various challenges you may be facing. Ultimately, our goal is to help you achieve your goals…and transform your professional success into personal significance.

Step 1: The Bridge Conversation®

The Bridge Conversation® – The purpose of the Bridge Conversation® is to facilitate a dialogue that allows you and your spouse to gain a shared perspective on what is important to each of you. This discussion brings clarity to your values, goals, and current financial position. Ultimately, The Bridge Conversation® is the foundation on which you build the financial house that you want.

Step 2: Design a Plan

Once we know what you want to achieve, our team develops a chronological, step-by-step plan of action that is designed to give you a high probability of achieving your goals. We’ll help you identify resources needed to support your plan and make sure everyone you’re working with is doing their best to help you implement your plan and achieve your goals.

Step 3: Implement Your Plan

Our goal is not just to create a great plan, but to ensure you have everything you need to follow through on the implementation of your plan. Implementation is essential for you to achieve your goals. Many of our clients find the Bridge Conversation® especially helpful in this phase—it reminds them what they’re working for and why they started planning in the first place.

Step 4: Ongoing Management

As we work with you, we’ll help you take care of the things you don’t want to do, don’t know how to do, or don’t have the time to do. Ultimately, we’re here to be your advocate for all things financial. When you require resources outside of our expertise, we’ll help you find competent, reliable experts that can help you make smart choices.

Step 5: Monitor and Optimize

We monitor your progress with a proprietary progress reporting system. We’ll meet with you three times a year to discuss where you are and how you’re advancing toward your goals. We’ll discuss how to reduce debt, strengthen your financial foundation, address risks, and optimize your estate. We’ll also ask five specific questions regarding your money:

-

- What do you have and where is it?

- What did you start with?

- What did you put in or take out?

- What have your investments gained or lost?

And most importantly…

- Are you on track to achieve your goals?

At the end of the day, this is the most important question. We want to see how far ahead or behind you are so we can help you stay on track to fulfill your values and achieve your vision.